In addition to grappling with stubbornly high construction costs, the commercial real estate industry continues to face a shortage of appealing sites, and fluctuating markets. High interest rates and tighter lending standards are adding pressure to projects, whether refurbishment, deep retrofit, or new development, writes Ben Kearns, Partner and Head of Venture, Workman Projects, in Development Finance Today.

It’s therefore more important than ever that project teams are rigorous and efficient in establishing project viability, to avoid abortive costs amassing in pursuit of options which are simply unviable. The feasibility tightrope has never been narrower.

Rigorous project evaluation means turning over stones quickly to assess potential returns, helping to unearth the best opportunities. Acting with speed is critical.

Working with teams who are experts in their sector draws upon live experiences, with lessons to be shared. This accelerates the identification of threats and opportunities for a project.

Market knowledge, paired with a solid grasp of the clients’ objectives, is a fundamental skill. When applied effectively, this helps ensure the team focuses its time and cost on what matters. Losing focus and expanding options is a pitfall when seeking to identify viability — work therefore requires clarity to avoid becoming distracted by detail, delaying the ability to run appraisal modelling.

Although heightened risk exists throughout the early project stages, holding a vision that is underpinned by expert experience helps ensure speed is maintained. Moving quickly to prepare the outline accommodation schedule and initial budget allowances will shape an appraisal.

Shape core viability

Of course, budget allowances will need to be made upon working assumptions. Here, striking the tone between optimism and pessimism will be an art and not a science, so market knowledge and experience will help provide the clearest view.

It’s vital not to get drawn into expanding a brief too far; remember the first stage is to shape core viability. Unlimited optioneering can muddy the water, detracting from the core analysis.

Technologies such as optioneering powered by generative AI design, simulations, and building information modelling can allow companies to model a building’s performance and carbon footprint, and estimate both cost and schedule up front, thereby enabling seamless project delivery. These technologies can also improve efficiency, increase delivery confidence, and streamline resource allocation, ultimately lowering project expenses and risks.

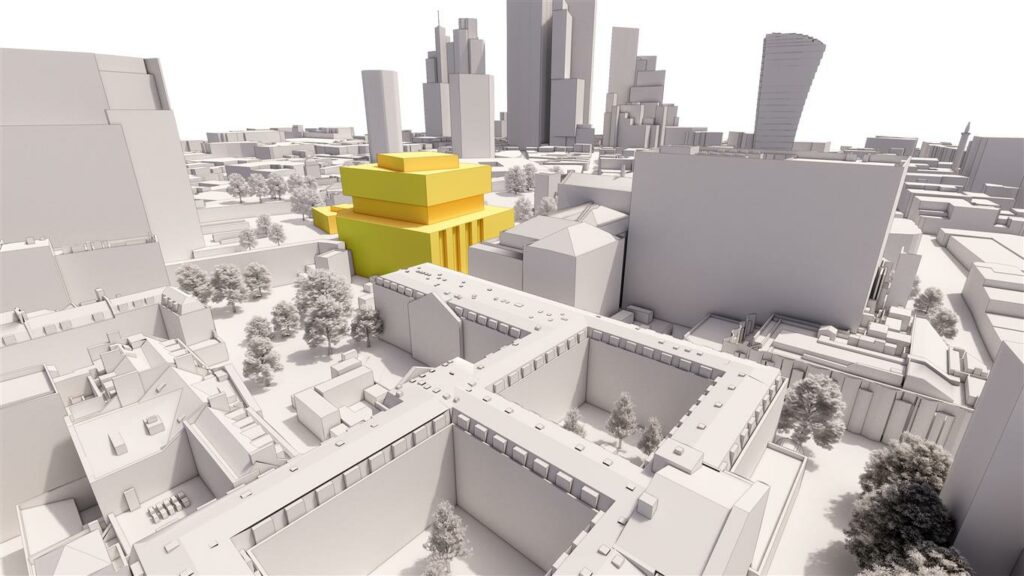

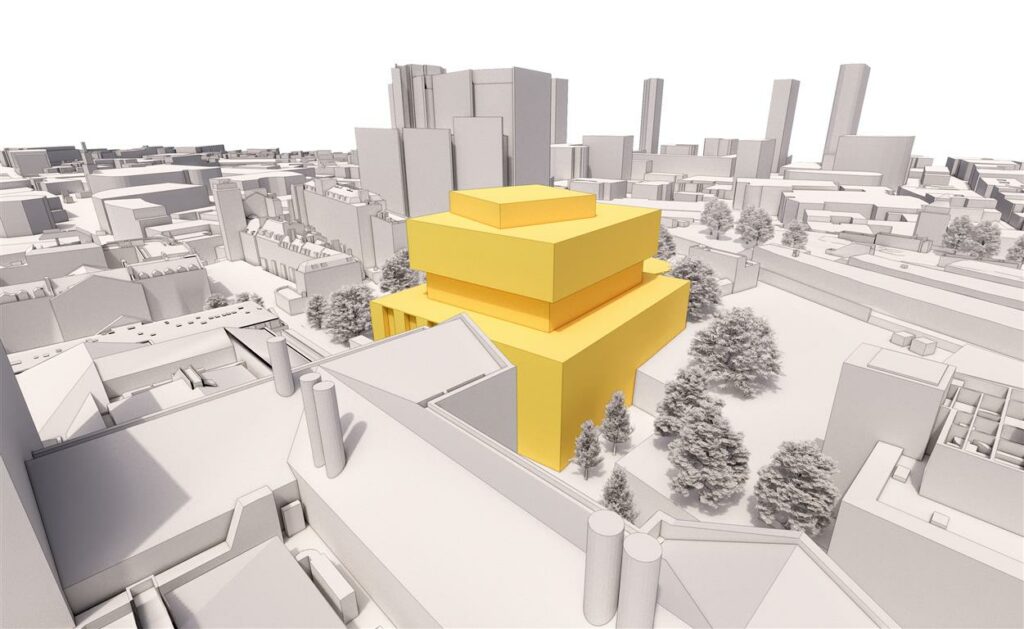

Three-dimensional computer-generated models (pictured) enable a proposal’s impact on its surroundings to be realised quickly and manipulated at pace.

Computer-generated models will help inform the impact of key viability considerations including accommodation schedules, rights of light compensation events, Townscape integration and energy modelling.

Once a baseline concept and appraisal has been established, the design team and engineers will need to work in tandem within one another. The timing of introducing the workflow requires effective management to ensure the investment is met with results. Be the first to the punch — but understand there is a cost commitment when throwing it. Volatile markets require continual review of how to extract best value from supply chains and keep them moving quickly. Opportunities and threats in the supply chain mean that procurement strategy also needs to be established during initial phases — this will help ensure the team is structured and engaged in a manner that best integrates with the live and moving contracting market. No one wants to pay contractor risk penalties for unresolved design work.

Regional and local resilience underpins good projects. Understanding where these are and how they are accessed requires work. Thorough feasibility studies underpin the most successful projects from the very beginning, relevant experience will be pivotal.